Saving money can be tough. It’s easy to spend money without even thinking about it, and putting money aside each month can sometimes seem impossible. But there is at least one incredibly effortless way to save money regularly. Here’s my experience with roundups, and why I think everyone should be using them!

What are roundups?

Roundups are a feature that many banks now offer. They work by rounding up your debit card purchases to the nearest pound (or dollar, etc.), and then transferring the difference to a savings account. For example, if you spend £2.50 on a coffee, your bank would round that up to £3.00 and transfer the extra £0.50 to your savings account.

Roundups are a great way to save money because they’re so easy and automatic. Once you’ve turned them on and selected a savings account to send your roundups to, you don’t even have to think about them. They just happen in the background, and over time, they can add up to a lot of money.

How much can you save with a roundup feature?

You might think that saving a few pennies here and there won’t make much of a difference, but you’d be surprised how quickly it adds up.

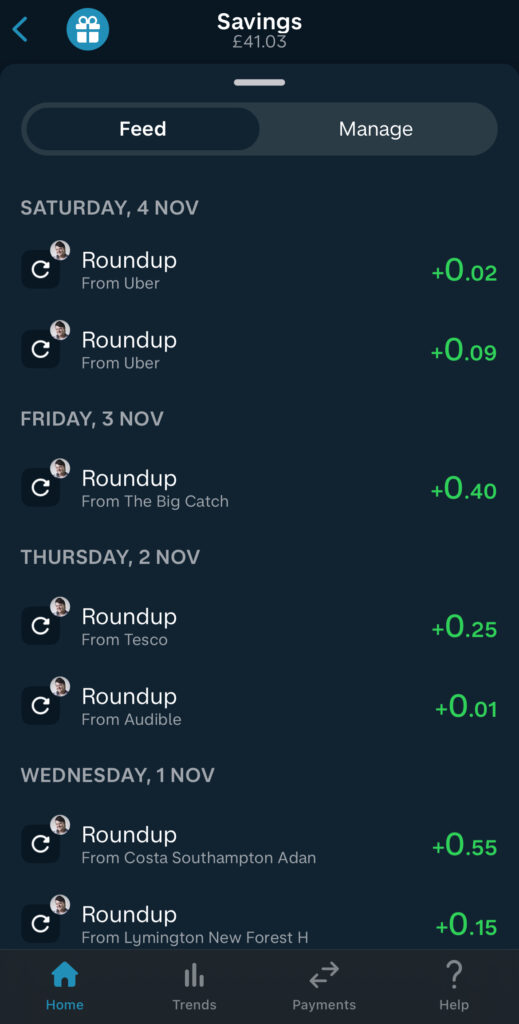

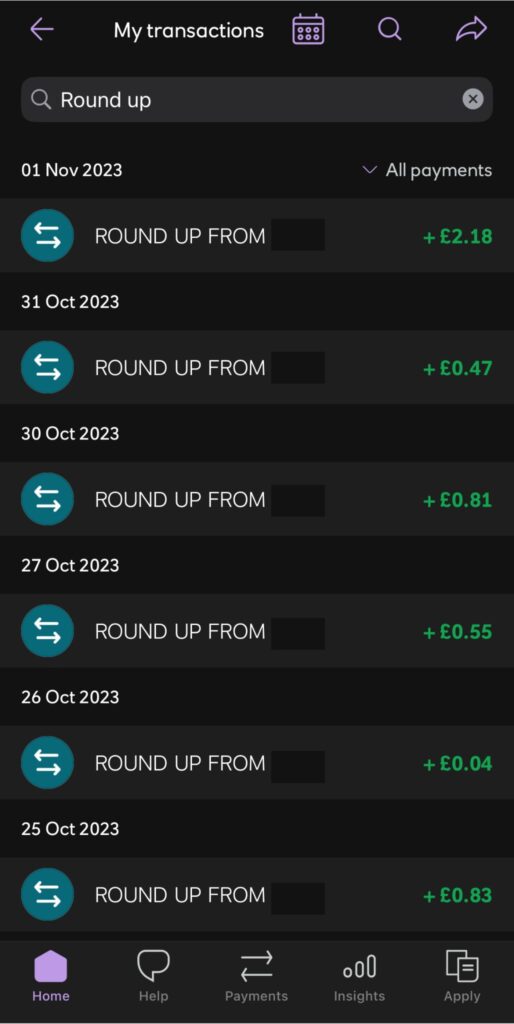

I must confess; I was shamefully late to the roundups party. I only activated the feature on my NatWest current account in early August 2023, and then on our Monzo joint account later that same month. However, in just about three months, I’ve saved a total of £88.82 from roundups alone. At the same sort of pace, that would be around £350 a year, for absolutely zero effort. And importantly, it’s money I don’t even notice leaving my account. Whether a tank of fuel costs my current account £54.67 or £55 makes very little difference to me in the everyday sense. But it all adds up in my savings account!

Moneybox claims that its customers save on average £12.37 per week from round ups alone, which is over £640 a year. Clearly, I don’t spend as much as those fine people.

Plus of course, as The Guardian stated in 2022:

Taking advantage of automaticity (where you set yourself up to do things without having to think about them) is the centrepiece of positive, habit-forming advice

The Guardian

And you know how I feel about forming positive habits! No? I wrote about Atomic Habits here and Habitica here.

Here are a few of the benefits of using your bank’s roundups feature:

- It’s easy and automatic. Once you set it up, you don’t have to do anything else. Your bank will round up your debit card purchases and transfer the difference to your savings account automatically.

- It’s a painless way to save money. You won’t even notice the small amounts of money that are being transferred to your savings account. But over time, they can add up to a lot of money.

- It’s a flexible way to save. You can choose to save money towards a specific goal, such as a down payment on a house or a holiday. For us, it’s a wedding fund! Or you could simply save money for a rainy day.

- No need for sacrifice. Traditional saving methods might require you to cut back on spending or make significant sacrifices. With roundups, you can continue your regular spending habits while still building your savings.

- It’s oddly satisfying. Some accounts, such as Monzo, will show the rounded transaction in your transaction list, making all your transactions look perfectly polished! Don’t worry, you can still see the “real” cost of the transaction without the roundup when you click into it.

- Track your progress. Many banking apps that offer the roundups feature also provide tools to help you track your savings progress. You can see how much you’ve saved over time and set goals to keep you motivated.

- It’s for everyone. Roundups are an inclusive saving tool that’s accessible to people of all income levels. Whether you’re making small or large transactions, you can benefit from this feature.

Getting the most out of your roundups

Here are a few tips for using roundups effectively:

- Choose a savings account that earns a good rate of interest to help your money grow faster

- Consider setting a goal for your savings to help you stay motivated to save money and potentially top up your savings as you see them grow

- Review your roundups regularly to ensure that the amount of money being transferred to your savings account is appropriate for your budget and not leaving you short

Niche bonus tip!

Some banks have savings accounts with awesome rates but monthly limits on how much you can save. However, you might find that they don’t count roundups within that limit, allowing you to get more out of your high interest rate savings accounts. For example, I have a NatWest Digital Regular Saver with a 6% gross interest rate, but I can only add £150 to it each month. However, NatWest allows me to send my roundups to this account and doesn’t count that money within my monthly limits. This means I actually end up saving more like £160-170 a month. Win!

It’s got to be worth a try, right?

If you’re not already using your bank’s roundups feature, I encourage you to turn it on today and give it a try. It really is the easiest money you’ll ever save, without even thinking about it.

What would you do with an extra £350-£640+ cash each year? It would certainly make a nice holiday fund. Or perhaps that’s Christmas presents sorted! Let me know how you’d use your roundups savings in the comments!